Gadget Insurance

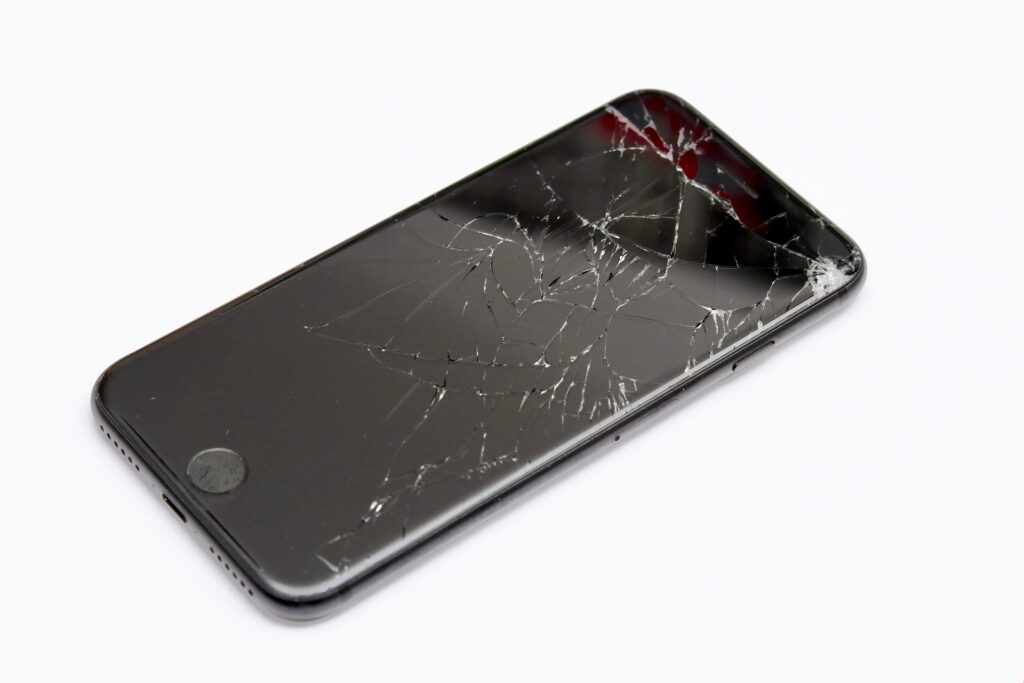

Should I Insure My Gadgets Separately? If you have more than one or two gadgets you need to insure, a multi-gadget insurance policy could save you money and work out to be a more cost-effective option. It’s definitely worth looking at the costs of having separate policies for your gadgets versus a multi-gadget policy. Most […]